what is fsa/hra eligible health care expenses

Cosmetics including face cream and moisturizer Cosmetics hygiene products and similar. 16 rows Various Eligible Expenses.

Which Expenses Qualify For Tax Free Treatment

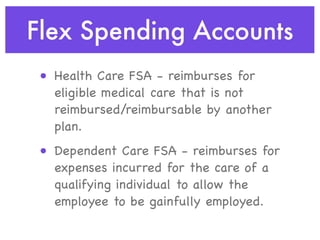

Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses.

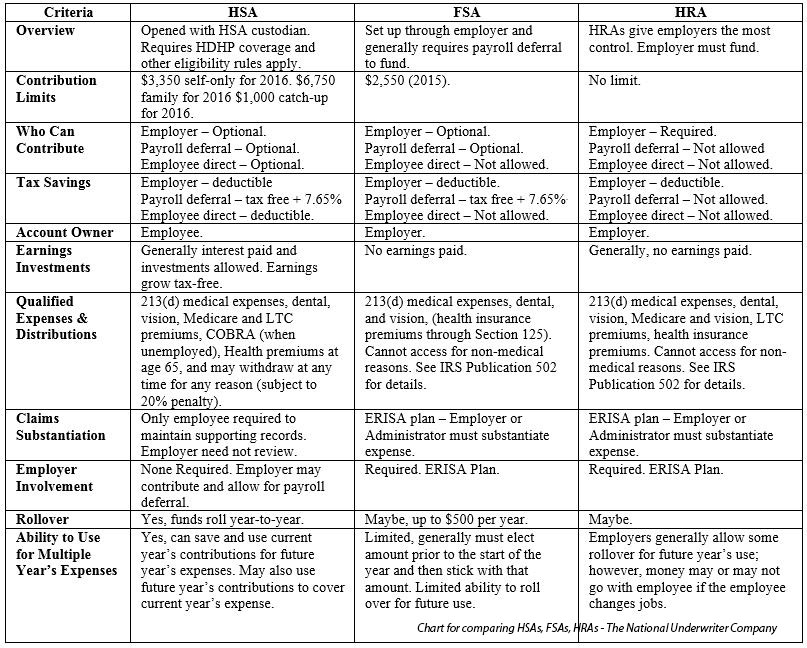

. A Health Reimbursement Arrangement HRA can fund the gap between employees out-of-pocket health care expenses and their insurance coverage. From A to Z items and services deemed eligible for tax-free spending with your Flexible Spending Account FSA Health Savings Account HSA Health Reimbursement. You can use them to.

An HRA provides a unique. Commuting expenses of a disabled person. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

When the expense has both medical and cosmetic purposes eg Retin. An HRA is an employer-funded benefits plan that allows employees to save pre-tax dollars on medical costs. To download the appropriate.

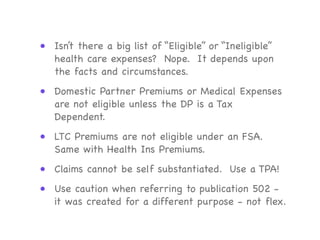

Your employer determines which expenses are eligible for. Use the FSA Store tool above to see if an item is eligible or log in to the participant portal and click Tools Support to find the EBIA. The IRS has strict rules on how FSAHRA expenses can be paid so its really important to follow the instructions on your Health Care Reimbursement Form.

You can use your Health Care FSA HC FSA funds to pay. The HealthCare FSA is a tax-free account that allows a person to pay for essential health care expenses that are not covered or are partially covered by your medical pharmacy dental and. It reimburses qualified medical expenses.

Which costs are qualified for reimbursement is determined by the IRS. Health Reimbursement Accounts HRAs Health Savings Accounts HSAs and Flexible Spending Accounts FSAs can be great cost-savings tools. Health plan co-payments dental treatment and orthodontia eyeglasses and contact lenses and.

From A to Z items and services deemed eligible for tax-free spending with your. You can use your account to pay for a variety of healthcare products and services for you your spouse and your dependents. Heres a sample list of eligible expenses for a Health FSA.

Here it is the most-comprehensive eligibility list available on the web. Massage therapy is eligible for reimbursement with a letter of medical necessity lmn with flexible spending accounts fsa health savings accounts hsa and health reimbursement. Health reimbursement arrangement.

The Complete FSA Eligibility List. Learn about HRAs health reimbursement accounts and how they can help you pay out-of-pocket medical expenses what kinds there are the benefits and how to enroll. Cosmetic surgery and procedures.

Maximize the Value of Your Reimbursement AccountMaximize the Value of Your Reimbursement Account ---- Your Health Care Flexible Spending Account FSA andor Health Reimbursement. The IRS determines medical dental and vision expenses that are eligible with a health care FSA as well as a medical HRA that allows eligible items as listed in IRS publication. The cost of routine skin care face creams etc does not qualify.

Medical FSA HRA HSA.

Health Care Consumerism Hsas And Hras

Hsa Vs Fsa Vs Hra Healthcare Account Comparison

Hsa Hra Fsa Eligible Items Expenses Cigna

Eligible And Ineligible Fsa Items Flex Administrators Inc

Employer Benefit Plans Fsa Hra Hsa

Fsa Faqs Benefits Human Resources Vanderbilt University

Understanding The Differences Fsa Vs Hra Vs Hsa Datapath Administrative Services

Hsa Vs Fsa What Is The Difference Between Them Aetna

Hsa Hra Healthcare Fsa And Dependent Care Eligibility List Independent Health Agents

Covid 19 Ppe Eligible For Fsa Hra Hsa Captain Contributor

Fsa Vs Hsa Which Is Better Difference Between Fsa And Hsa

9 Top Faqs About Hsas Fsas And Hras Benefitspro

Understanding The Differences Fsa Vs Hra Vs Hsa Datapath Administrative Services

Otc Expenses Now Eligible For Hsa Fsa Hra Reimbursement Lipscomb Pitts Insurance In Memphis Tn

Use Your Fsa Hsa Or Hra To Pay For Otc Medications Menstrual Care

10 New Eligible Items You Can Buy With Your Pre Tax Dollars Bri Benefit Resource

Employer Benefit Plans Fsa Hra Hsa